In today’s fast-paced and ever-changing world, earning a stable income can feel like a never-ending challenge. As technology evolves and industries shift, the idea of “earning tuffer” has gained popularity. But what does this phrase really mean? At its core, earning tuffer refers to building a resilient income stream that can withstand economic fluctuations, personal setbacks, and the unpredictability of life. It’s not just about earning more money but doing so in a way that is sustainable, reliable, and tough enough to weather any storm.

The importance of resilience in the modern economy cannot be overstated. With the rise of gig work, remote jobs, and digital entrepreneurship, more people are seeking flexible ways to earn a living. But with flexibility comes uncertainty. Earning tuffer means preparing for this uncertainty by diversifying income streams, developing key skills, and staying mentally strong through challenges.

Developing a Resilient Mindset for Success

The Power of a Growth Mindset

Success starts with the right mindset. A growth mindset—the belief that abilities and intelligence can be developed—can transform how you approach earning. Rather than being discouraged by setbacks, those with a growth mindset see challenges as opportunities to learn and grow. They embrace difficulties and push through, knowing that resilience is key to long-term success.

Overcoming Financial Setbacks

Everyone faces financial setbacks at some point. Whether it’s losing a job, an unexpected expense, or a business failure, the key to earning tuffer is not avoiding setbacks but learning how to recover from them. This requires discipline, adaptability, and a willingness to adjust strategies when things don’t go as planned.

How Persistence Shapes Long-Term Financial Stability

Persistence is the foundation of earning tuffer. Building a strong income stream doesn’t happen overnight. It takes time, effort, and determination. The most successful people are those who continue to push forward, even when progress seems slow. In the long run, persistence pays off by creating financial stability that lasts through both good and bad times.

Diversifying Income Streams for Financial Security

The Role of Passive Income in Building Wealth

One of the smartest ways to earn tuffer is by diversifying your income streams. Passive income—money earned with little to no ongoing effort—can be a game changer. This might include investments in stocks, rental properties, or online ventures like affiliate marketing. The idea is to create income sources that work for you, even when you’re not actively working.

Active Income Sources: Turning Skills into Cash

While passive income is important, active income—money earned from your direct efforts—is equally essential. This might include a traditional job, freelance work, or a side hustle. By using your skills to generate income in multiple ways, you reduce the risk of depending on a single source of money.

Combining Active and Passive Income for Stability

The real key to financial security is combining active and passive income streams. This ensures that even if one source of income dries up, others can continue to provide. For example, you might work a full-time job (active income) while also earning money from a blog or YouTube channel (passive income). Together, these streams create a robust and tuffer financial safety net.

Strategies for Earning Tougher in a Digital World

Leveraging Online Opportunities to Earn Tuffer

The digital world offers countless opportunities for those looking to earn tuffer. From e-commerce to digital marketing, there are more ways than ever to make money online. Whether you’re selling products, providing services, or creating content, the key is finding your niche and building a strong online presence.

Building an Online Business from Scratch

Starting an online business is one of the best ways to earn tuffer. It gives you control over your income and allows you to scale as your business grows. Whether it’s an online store, a blog, or a digital service, the possibilities are endless. But success requires careful planning, persistence, and a commitment to learning as you go.

Freelancing and Gig Economy: Flexible Income Options

The gig economy has exploded in recent years, providing flexible ways to earn money. Freelancers can offer their services on platforms like Upwork or Fiverr, while gig workers can earn money through apps like Uber or DoorDash. These options allow you to earn tuffer by taking on multiple gigs or clients, creating a more diversified income stream.

How to Thrive in a Competitive Digital Market

Competition in the digital space can be fierce, but it’s not impossible to stand out. To earn tuffer, focus on building a personal brand, offering unique value, and consistently improving your skills. Whether you’re a freelancer, entrepreneur, or content creator, the more you differentiate yourself, the more resilient your income stream will be.

Overcoming Challenges in the Quest to Earn Tuffer

Common Roadblocks to Financial Growth

Building a resilient income stream isn’t easy. Common challenges include lack of capital, limited skills, and fear of failure. Recognizing these roadblocks is the first step to overcoming them. By identifying your weaknesses, you can create strategies to address them and continue moving forward.

Dealing with Failure and Rejection

Failure and rejection are inevitable parts of any financial journey. Whether it’s a business venture that doesn’t take off or a client that turns you down, learning to accept and move past these setbacks is essential. Instead of seeing them as defeats, treat them as learning experiences that can make you stronger and better prepared for future success.

How to Keep Going When the Going Gets Tough

The road to earning tuffer is often long and difficult. When challenges arise, it’s easy to feel discouraged. But staying focused on your long-term goals, seeking support from mentors or peers, and breaking down large goals into smaller, achievable tasks can help you push through tough times.

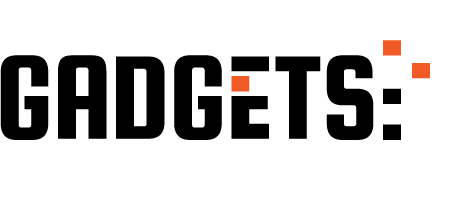

Smart Financial Planning for a Tuffer Income

Creating a Solid Financial Plan

A strong financial plan is essential for earning tuffer. This includes setting clear goals, creating a budget, and tracking your progress over time. By managing your money wisely, you’ll be better equipped to handle financial setbacks and take advantage of new opportunities.

Budgeting and Saving for the Future

Budgeting is one of the most effective ways to earn tuffer. By tracking your expenses and saving a portion of your income, you create a cushion that can help you weather tough times. A solid budget also allows you to invest in opportunities that can grow your income over time.

The Importance of Emergency Funds

An emergency fund is a critical component of earning tuffer. This fund serves as a financial safety net, helping you cover unexpected expenses without going into debt. Financial experts recommend saving at least three to six months’ worth of living expenses in an easily accessible account.

Investing for Long-Term Financial Resilience

Investing is one of the most powerful ways to build wealth over time. By putting your money into stocks, bonds, real estate, or other investment vehicles, you can grow your wealth while minimizing risk. Long-term investing allows you to earn tuffer by creating a financial future that’s secure and stable.

Learning New Skills to Boost Your Income

Identifying High-Income Skills

One of the fastest ways to earn tuffer is by developing high-income skills. These are skills that are in high demand and can command higher pay. Examples include coding, digital marketing, and project management. By honing these skills, you can increase your earning potential and create more opportunities for financial growth.

Online Courses and Certifications to Earn More

The internet is full of resources to help you learn new skills and boost your income. From free tutorials on YouTube to paid courses on platforms like Udemy or Coursera, you can find training on almost any topic. Certifications in areas like IT, finance, or healthcare can also increase your earning power by making you more competitive in the job market.

Staying Competitive in a Fast-Changing Job Market

The job market is constantly evolving, and staying competitive is crucial for earning tuffer. This means continuously upgrading your skills, staying informed about industry trends, and being adaptable. By staying ahead of the curve, you’ll be better positioned to take advantage of new opportunities and maintain a resilient income stream.

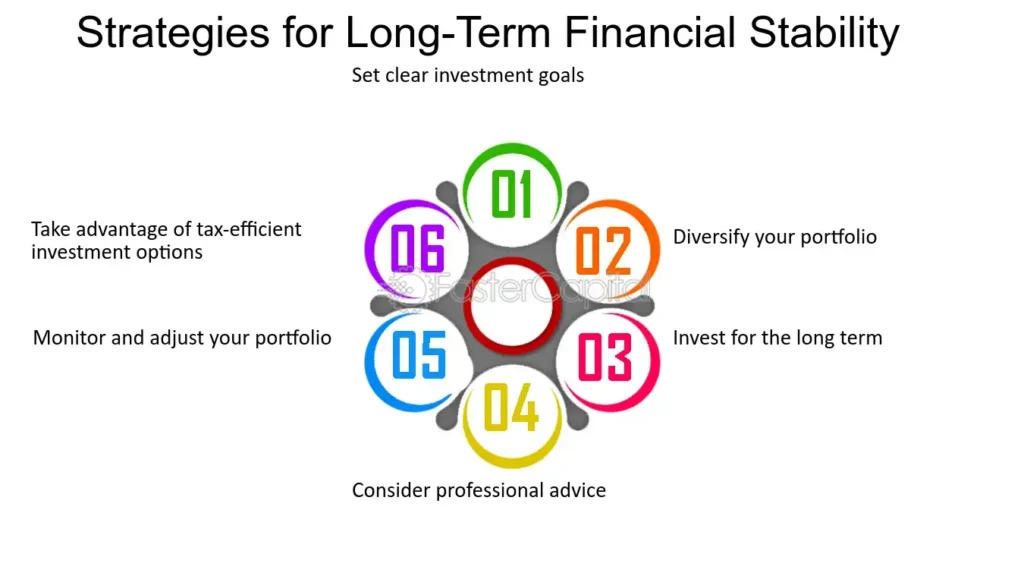

Entrepreneurship: A Path to Earning Tuffer

Why Entrepreneurship Requires a Tough Mentality

Entrepreneurship is one of the most rewarding but challenging ways to earn tuffer. It requires a strong mentality, as business owners face constant challenges, from securing funding to attracting customers. Those who succeed are the ones who remain tough, adapt to changing circumstances, and keep pushing forward, even when the odds seem against them.

Starting a Business with Little Capital

Many people believe that starting a business requires a lot of money, but that’s not always the case. Thanks to the internet, you can start an online business with minimal capital. Whether it’s an e-commerce store, a blog, or a digital service, there are numerous low-cost ways to get started. The key is to start small, focus on growing gradually, and reinvest profits into your business.

How to Scale Your Business for Maximum Profit

Once you’ve established your business, scaling is the next step to earning tuffer. Scaling involves growing your business in a way that increases profits without a proportional increase in costs. This might include automating processes, expanding your product line, or outsourcing tasks to free up your time. A scalable business is more resilient and can generate higher income over time.

Investing in Yourself: The Key to Earning Tuffer

Continuous Learning for Financial Success

One of the best investments you can make is in yourself. By continually learning and improving your skills, you increase your value in the marketplace. This might include taking courses, reading books, or attending conferences in your industry. The more you know, the better positioned you’ll be to seize new opportunities and earn tuffer.

Building Strong Networks to Support Your Goals

Success isn’t achieved in isolation. Building a strong network of mentors, peers, and industry connections can provide invaluable support on your journey to earning tuffer. These relationships can offer advice, introduce you to new opportunities, and help you stay motivated during tough times.

Health and Well-being: A Foundation for Earning Tuffer

Earning tuffer isn’t just about financial resilience—it’s also about physical and mental resilience. Taking care of your health ensures that you have the energy, focus, and stamina needed to pursue your goals. Regular exercise, a balanced diet, and mental health practices like meditation can all contribute to a stronger foundation for earning tuffer.

The Role of Technology in Helping You Earn Tuffer

Automation Tools for Entrepreneurs and Freelancers

Technology has made it easier than ever to earn tuffer. Automation tools can streamline many of the tasks that used to take up valuable time, from managing social media to processing payments. For entrepreneurs and freelancers, using tools like Zapier, Hootsuite, or QuickBooks can free up time to focus on growing your business or taking on more clients.

How Artificial Intelligence Can Boost Your Income

Artificial intelligence (AI) is transforming industries and opening up new ways to earn money. From AI-powered chatbots to data analysis tools, AI can help businesses operate more efficiently and increase profits. By embracing these technologies, you can stay ahead of the curve and create new income streams.

Using Social Media to Expand Your Income Potential

Social media platforms like Instagram, YouTube, and TikTok offer powerful opportunities to earn tuffer. Whether you’re promoting products, offering services, or building a personal brand, social media allows you to reach a global audience. With the right strategy, you can turn your online presence into a lucrative income stream.

Balancing Risk and Reward: Earning Tuffer with Smart Decisions

Understanding Risk Management in Business and Investments

Earning tuffer often involves taking risks, but not all risks are created equal. Understanding how to manage risk is crucial for long-term success. Whether you’re investing in the stock market or starting a business, it’s important to weigh the potential rewards against the risks. Diversification, research, and cautious decision-making can help you manage risk effectively.

Making Informed Financial Decisions

Informed financial decisions are the backbone of earning tuffer. This means doing your homework before making any investment, business decision, or financial commitment. Whether it’s reading up on the stock market or consulting with a financial advisor, the more information you have, the better your chances of success.

How to Avoid Get-Rich-Quick Scams

In the quest to earn tuffer, it’s easy to fall for get-rich-quick schemes that promise instant wealth. However, these scams often lead to financial ruin. To avoid them, it’s important to be skeptical of any opportunity that seems too good to be true. Focus on building wealth slowly and steadily through legitimate means, rather than chasing quick wins.

The Future of Earning Tuffer: Trends to Watch

The Gig Economy and Future Work Trends

The gig economy is expected to continue growing in the coming years, offering more opportunities for flexible work. Whether you’re a freelancer, contractor, or gig worker, staying informed about trends in this sector can help you position yourself for future success. The ability to adapt to changing work environments will be essential for earning tuffer in the future.

The Impact of AI and Automation on Jobs

AI and automation are rapidly transforming industries and the job market. While some jobs may disappear, new opportunities will also arise. To earn tuffer in the future, it’s important to stay ahead of these changes by learning new skills and being adaptable.

New Ways to Earn Money in the Future

As technology continues to evolve, so will the ways we earn money. From blockchain to virtual reality, new industries and opportunities are emerging that could change how we work and make a living. Staying informed about these trends will help you stay competitive and continue earning tuffer.

Staying Motivated on the Path to Earning Tuffer

Setting Goals and Tracking Progress

Setting clear, achievable goals is crucial for staying motivated on the path to earning tuffer. Whether you want to increase your income, pay off debt, or start a business, breaking down your goals into smaller, manageable steps can help you stay focused and motivated.

Finding Inspiration and Staying Focused

There will be times when earning tuffer feels overwhelming. During these moments, it’s important to find inspiration, whether it’s from successful entrepreneurs, motivational books, or personal mentors. Staying focused on your long-term vision will help you push through challenging times.

Celebrating Small Wins to Stay Energized

Earning tuffer is a long-term journey, and it’s important to celebrate small victories along the way. Whether it’s landing a new client, hitting a savings milestone, or learning a new skill, acknowledging your progress can keep you motivated and energized.

Conclusion

Earning tuffer is about more than just making money—it’s about building a financial future that’s resilient, sustainable, and adaptable to whatever life throws your way. By developing the right mindset, diversifying your income streams, and continuously learning and adapting, you can create a financial foundation.